Retirement is a difficult adjustment for older people who spent most of their lives working. Your parents might be physically ready to retire, but they’re still mentally and emotionally attached to their work lives. They might also have some financial or legal matters to clear up. Here are seven ways you can help your parents ease the transition into the next stage of their lives.

Break the Ice With a Conversation

An honest conversation goes a long way. Start by sitting down with your parents and talking about their plans for retirement. Try to flesh out their feelings about ending their careers. Many new retirees struggle to fill their free time because they’re so accustomed to having full-time jobs. Staying busy is a key part of a happy retirement.

Once you break the ice, discuss some ideas about their retirement plans. What projects could they pursue in the coming years? Home renovations? Travel? Are they interested in picking up any new hobbies?

This initial conversation is a must-have if your parents are nervous about entering retirement. They worked tirelessly for decades, saving their hard-earned money to enjoy their final years in peace and quiet. They’re going to be emotional about the change, so you must be the rational voice in the discussion.

Organize Legal Documents

Before officially starting retirement, your parents need to organize their legal documents and make sure their information is up to date. These pieces of information are essential for smart retirement and end-of-life planning:

- Birth certificate

- Social Security number

- Organ donor card

- Health care proxy

- Bank accounts

- Wills and trusts

- Pensions

Consolidating all of your parents’ private information in one place helps them retire with greater peace of mind. It will also help you and your lawyer when they pass away and leave their belongings behind.

Be Honest About Their Health

The aging process can hit older adults like a truck. They start to feel the effects of their long careers and lose the ability to do basic tasks. Retirement will make your parents more comfortable, but it won’t make their health problems disappear. You need to assess their living situation and ask an honest question: Can they take care of themselves full-time?

If you think your parents could benefit from assisted living, you should start looking into retirement communities. They might not like the idea at first, so you have to make them understand that it’s for their own good. Show them what retirement communities have to offer, such as enrichment opportunities that enable them to continue their hobbies and lifestyles.

Clarify Their Money Situation

Now that you’re a grown adult, you should have at least a vague picture of your parents’ money situation. Go over their savings to determine if they’re 100% financially ready for retirement. Calculate their living expenses, investments, and savings. Make sure they don’t have any substantial outstanding debts.

Settling debts is crucial for ensuring a stress-free retirement. Your parents should have no financial obligations to lenders besides the monthly bills. If they do have outstanding debts or their savings aren’t sufficient for the long term, they should consider getting a part-time job to give themselves more financial stability.

Set Them Up With Benefits

Clarifying your parents’ money situation will also help your parents get the benefits they deserve. They might qualify for many benefits on the local, state, or federal level. Some retirees don’t like the idea of requesting government assistance, but they should take full advantage of their eligibility. Here are some benefits they might qualify for:

- Mortgage or reverse mortgage assistance

- Utility and phone bill assistance

- Property tax assistance

- HUD public housing for citizens aged 50+

- Section 8 Housing Choice Vouchers for 62+ citizens

- USDA Housing Repair Program for 62+ citizens

- Federal income tax credit for 65+ citizens with limited income

Everyone in your family will feel more at ease knowing your parents have some guaranteed basic necessities. Government benefits will also influence your decision to pursue assisted living services. If they have clean public housing with helpful residents nearby, a retirement community might not be necessary.

Update Their Insurance Plans

Your parents’ risk of injury is higher in old age, so they need the best possible protection from their insurance plans. Update their homeowner’s, auto, health, and life insurance policies to make sure they have full coverage and aren’t overpaying. A long-term disability insurance policy might also be necessary.

In a perfect world, your parents will remain healthy for decades and never have to rely on insurance coverage. But we don’t live in a perfect world, so you must take all available precautions to protect them if something goes wrong.

Teach Them About Online Safety

People aged 60+ are five times more likely than young adults to fall for phishing and other online scams. These cyberattacks rob retirees of their hard-earned savings and can destroy their peace of mind. You must teach your parents about various online scams and how to safely navigate the internet.

For example, make sure they never share their private information with strangers online or over the phone. Show them how to spot suspicious activity on their social media accounts, bank accounts, and other platforms with sensitive information. Give them constant advice and support to ensure their financial security and well-being.

Return the Favor

Your parents devoted their lives to giving you a happy childhood. Now it’s time to return the favor. Help them manage the stress of retirement planning by applying these seven tips. They will help create a secure financial situation and ensure their needs are taken care of, allowing them to enter retirement with a clear conscience and peace of mind.

p.s. Related posts:

How to Prepare to Move Your Aging Parents into Your Home with You

What’s a Skilled Nursing Agency and How Books Can Aid Recovery

Healthy Living for Our Elders #AgingWell

Delivering Thanksgiving Dinner to the Elderly: Our Hasbro Kindness Project

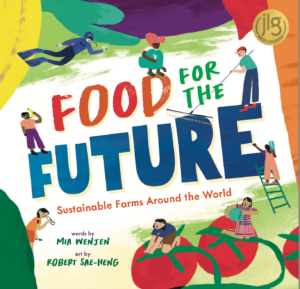

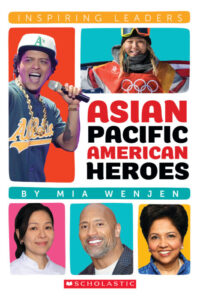

To examine any book more closely at Indiebound or Amazon, please click on image of book.

As an Amazon and IndieBound Associate, I earn from qualifying purchases.

My books:

Food for the Future: Sustainable Farms Around the World

- Junior Library Guild Gold selection

- Selected as one of 100 Outstanding Picture Books of 2023 by dPICTUS and featured at the Bologna Children’s Book Fair

- Starred review from School Library Journal

- Chicago Library’s Best of the Best

- Imagination Soup’s 35 Best Nonfiction Books of 2023 for Kids

Amazon / Barefoot Books / Signed or Inscribed by Me