Most parents start setting aside money for their children’s college education when they’re young. This method ensures that they can save reasonably without causing issues with everyday financial obligations. However, what happens if a parent decides to go back to school? Many adults come to this decision when their kids are older because it relieves many responsibilities. The only problem is that it makes things a lot more challenging.

Fortunately, neither you nor your child has to give up on their dreams of obtaining a degree. Below are some practical solutions to help you foot the bill.

Choose An Affordable School (For Parents)

Your teenager has been planning for college for the past few years now. They’ve likely decided on what school they want to attend and the degree program they wish to pursue. Of course, you don’t want your child to have to change their plans. Therefore, parents should search for the most affordable college or university to get their degree.

Community college is often the best option. They have multiple degree programs and often have lower tuition costs for local students. Many times, financial aid will cover a bulk of the expenses. Another option would be to consider an online school. Since they don’t have the same costs as a brick-and-mortar school, students often pay less for their education.

Apply For Scholarships

Free money is the best option when trying to pay for college. Scholarships are financial rewards that don’t require repayment. While your teen has likely started applying for scholarships, you should do the same. Believe it or not, there are a lot of scholarships for adults and continuing education applicants that you can use to your advantage.

Employer Assistance

Many companies support their staff by offering tuition assistance for individuals who wish to go to college. Your employer may be willing to pay a large portion of your educational expenses. Many of these programs require you to pay the tuition upfront, and then you’re reimbursed once you complete the course. Talk with your human resources representative to determine what options are available to you. Also, hold onto any receipts and transcripts to meet the requirements.

Work-Study Programs

Your teen may not have a job they can turn to for financial assistance, but many schools offer work-study programs. Your child would work on or near the school campus and receive compensation which can be used to cover tuition or other expenses associated with going to college. As these programs tend to fill up fast, you want to inquire and sign up as soon as possible.

Side Gigs

Last but not least, parents and students should consider getting a side gig to help with the cost of college. These are jobs that aren’t as demanding as a full or part-time job where you could earn a significant amount of money. Consider what you’re good at and try to find a side gig that matches your skills, interests, and lifestyle.

For instance, you could sell decor online. Some platforms allow you to create an eStore, manage social media posts, record live videos, manage inventory, and complete transactions online. As a business professional, there’s also the option to work as a freelancer or consultant and charge a fee to entrepreneurs and companies needing your services.

When it comes to your teen completing side gigs while in college, try to opt for things that aren’t too time-consuming or demanding that would disrupt their studies. They could start a blog or vlog, sell products online, answer surveys, or even do things like walk dogs and babysit on their days off.

There is no greater accomplishment for a parent than sending their child to college. However, when you consider the expense, it can be intimidating. Those costs increase if you decide that you want to go back to school. Be that as it may, you don’t have to give up on your dreams. While it may require a bit more effort on your end, there are multiple ways to cover the cost of both of your educational expenses, without going bankrupt. Use the tips listed above so that you and your child can go to college without stressing over money.

Photo by Olia Danilevich

p.s. Related posts:

How To: Pay for College from Dr. Michele Borba

Best 529 College Savings Plans (from Morningstar)

How to Save Enough Money for Your Child’s College Education

College Savings for Child: Making Sure Your Kid Will Go to College

How Much Money is Too Much Money for College?

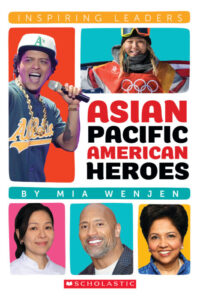

To examine any book more closely at Indiebound or Amazon, please click on image of book.

As an Amazon and IndieBound Associate, I earn from qualifying purchases.

Follow PragmaticMom’s board Multicultural Books for Kids on Pinterest.

Follow PragmaticMom’s board Children’s Book Activities on Pinterest.

My books:

Food for the Future: Sustainable Farms Around the World

- Junior Library Guild Gold selection

- Selected as one of 100 Outstanding Picture Books of 2023 by dPICTUS and featured at the Bologna Children’s Book Fair

- Starred review from School Library Journal

- Chicago Library’s Best of the Best

- Imagination Soup’s 35 Best Nonfiction Books of 2023 for Kids

Amazon / Barefoot Books / Signed or Inscribed by Me