College is a very good investment if you are looking to get ahead in the business world, with many studies showing that those who studied at an institute of higher education make more on average than those who don’t. The downside of this is the student debt — which can balloon into the tens and even hundreds of thousands of dollars — and the costs of living as a student. To help you think about whether or not college is the right choice for you, you should definitely be considering ways to pay for it properly. Here are five great ways.

Take Out a Federal Loan

One of the first avenues you should pursue when you are looking to pursue higher education is whether or not you are covered through either state or federal loans. The state government, now headed by a different party, has schemes in place to help those from low-income backgrounds make it to college, making it an attractive option to find the necessary cash.

Take Out a Private Loan

If a federal loan is not a good option, it might be a good idea to get a private student loan instead. Be careful with this choice just to make sure that the amount that you are repaying and the payments you are expected to make can be met. You can also get additional loans while you are already studying to cover any unexpected costs. Take a look now for a quick personal loan that can suit your circumstances.

Get a Part-Time Job

To help cover costs, a remarkable 80% of students now take a job to help them cover the cost of studies, with some of the most common industries being in hospitality or retail. This can be a great way to ensure a regular income while you are studying. Nonetheless, it’s important to make sure that you are not working too much as you could be running the very real risk of burnout, leaving you unable to successfully finish your studies.

Win a Scholarship

To get a discounted price on your college costs, as well as even win a bursary that can help you to cover everyday costs, it might be worth applying for a scholarship. Just be aware that if you decide to pursue this option it will take a lot of hard work in order to become truly eligible.

Ask For Help From Your Parents (and Grandparents)

Don’t forget who is always willing to fight in your corner in order to help you to realize your dreams. If they are in the economic position to do so, then there is no shame in asking your parents for help with going to college. They can help to pay for a portion of the fees or give you spending money that can be used on your studies. While you might feel guilty for taking their money, just remember that they will consider it an investment into your future, meaning that you can pay them once you have become a success.

and one more…

Start at Community College Then Transfer to a Four-Year College

Complete your general requirements at a local community college while living from home. Once you have completed your two-year degree, transfer to a four-year college. Your community college will likely have programs already set up with local four-year public colleges in your state to make this an easy transition. You might also want to check into financial aid including merit scholarships for students who are transferring from a community college.

p.s. Related posts:

Thinking and Stressing About College for My Oldest

How To: Pay for College from Dr. Michele Borba

College Savings for Child: Making Sure Your Kid Will Go to College

Science Internships for High School Students

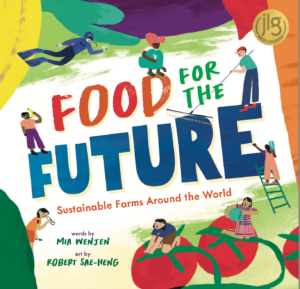

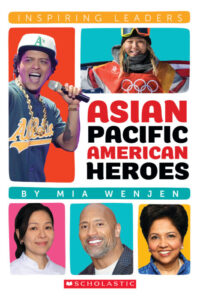

To examine any book more closely at Amazon, please click on image of book.

As an Amazon Associate, I earn from qualifying purchases.

My books:

Food for the Future: Sustainable Farms Around the World

- Junior Library Guild Gold selection

- Selected as one of 100 Outstanding Picture Books of 2023 by dPICTUS and featured at the Bologna Children’s Book Fair

- Starred review from School Library Journal

- Chicago Library’s Best of the Best

- Imagination Soup’s 35 Best Nonfiction Books of 2023 for Kids

Amazon / Barefoot Books / Signed or Inscribed by Me