Raising a family seemed more simple in the past. It was just the way things were back then. No matter what their professions, it seemed like people back then were to be able to raise and support a family as part of regular life.

The modern world is much different. With easy access to the world, competition in every field, and a more consumer-driven society, raising a family feels like it is more challenging than ever.

Starting from the pregnancy until your child is independent, you will have to financially support your child. Even after they leave the nest, you may still need to spend money on big-budget items like weddings.

Here are a few tips to help you manage your finances to save for the future. You can learn how to cover the costs of raising school-age children and make good financial decisions as a parent.

Family Budgeting

With every budget planning process, you first need to look at the money that you are bringing in and taking out of your bank account every month. Look over your bank statements for the last couple of months, and use that to forecast the year ahead.

You should look into any loans and mortgages you are currently paying. Also, calculate exactly how much you need to pay and how many online installment loans are left. Make note of the interest rate too.

With this information out in front of you, you can start building your budget using the details of your expenses. List out all of the essentials, like food, rent, utilities, monthly payments, and commuting, among others. Separate items into fixed expenses (the expenses that are the same every month such as your rent or mortgage payment) and those that are variable (such as entertainment or clothing). Now, you take a look at the extra and try to cut back as much as possible.

Remember, you will need to include money for school-related expenses and setting up a study space at home as well.

Building Savings

When you cut your spending, you automatically free up some cash. You can use this extra cash to open up a savings account or add to an existing one and let your money make money.

Before you open up a savings account, be sure it fits your needs. Also, go through the fine print of each savings account option.

The account doesn’t merely have to be your run-of-the-mill savings account. You can check many other specific ones as well. For instance, you can start a college fund or a wedding fund for your kids or consider kids’ custodial accounts to open as another option to save for their future. The banks and other companies offer extras with these specific accounts.

Insurance, Tax Breaks, And Other Essentials

Many parents often get too caught up in day-to-day life and may overlook some important things. If you have as well, or you didn’t know about it before, that’s ok. Let’s get on it.

Health Insurance

You may have a health insurance policy in place for yourself. When you have a baby, you may think that your insurance company would automatically add them to your policy. But they don’t.

You will need to call them up to update your policy. In case you’re wondering, this is one of those qualifying events that allows you to change your health insurance policy.

Tax Breaks

While former President Trump’s office didn’t end well, he may have done some good during his time.

Under the new laws, the Child Tax Credit has been doubled per child, from $1000 to $2000. That means you can now save $1,000 more every tax season on each of your children.

Also, the limits to qualify for this tax break for individual earner has increased from $75,000 to $200,000, and $110,000 to $200,000 for families. This gives more families tax breaks.

Other Essentials

You should also look into things like:

- Setting up beneficiaries for your financial accounts

- Updating your wills

- Updating your life insurance policies

Research and Avoid Over-Spending On Essentials

When you have one or more kids, you might need to purchase a lot of items. Many of them repeatedly or one for each kid.

The trick here to avoid going out of your family budget is to research every single product before making your purchase.

For instance, there are a few big-name disposable diaper brands in the market. While you may be tempted to provide your kids with the best, buying from lesser-known brands should be your aim. There isn’t much difference in quality, and your babies will never know the difference.

Reduce the Day-To-Day Expenses

Cut Back On Toys

Parents usually think it’s the more toys, the merrier when it comes to their kids. But that may not be the case.

You see, kids often play with toys a couple of times and then move on. They may come back to them after a while, but the initial excitement goes away.

Not only that, you may notice that your kid may enjoy playing with the packaging of toys or random objects around the house. Kids can be very creative, and this creativity can help you save money. Try things like cardboard boxes, making your own playdough, and plain paper bags as sources of inexpensive entertainment.

Reduce Your Food Costs

When you go out shopping for groceries the next time, consider buying in bulk. That means more oversized packaging of products.

For this, you have to plan your meals ahead of time and create a weekly shopping list for the items.

It would also be helpful if you prepare meals and freeze them for later. If you have a newborn or a toddler who has messed up your schedule, preparing meals for later whenever you get the time can be great.

Have Date Nights on a Budget

Just because you have children doesn’t mean there is no time to spend with your partner. While you may have to give your kids a lot of time, you should take some time and continue to nourish your relationship with your partner.

However, you should try to have date nights on a budget. That means using discounts, promotions, deals, and going to more affordable food places.

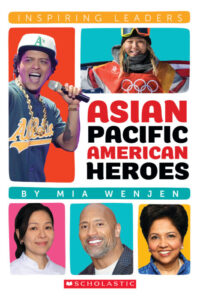

To examine any book more closely at Amazon, please click on image of book.

As an Amazon Associate, I earn from qualifying purchases.

Follow PragmaticMom’s board Parenting Village on Pinterest.

My books:

Food for the Future: Sustainable Farms Around the World

- Junior Library Guild Gold selection

- Selected as one of 100 Outstanding Picture Books of 2023 by dPICTUS and featured at the Bologna Children’s Book Fair

- Starred review from School Library Journal

- Chicago Library’s Best of the Best

- Imagination Soup’s 35 Best Nonfiction Books of 2023 for Kids

Amazon / Barefoot Books / Signed or Inscribed by Me