This post is sponsored by T. Rowe Price and Scholastic. The ideas and opinions are my own.

I am so happy to be joining Scholastic and T. Rowe Price to help parents teach their kids personal finance. I noticed from my kids that each came forth into the world with an innate sense of money.

My oldest, Grasshopper and Sensei, is an artist, and I’ve worked with her on how to earn money using her talent. She sells hand painted greeting cards, and is thinking about expanding her business by printing T-shirts. Her inclination towards money is:

- Spend it if you have it (thus she needs reinforcement to save).

- Art supplies are more important than food (thus she needs to work on her choices).

My middle daughter, PickyKidPix, is the polar opposite of her sister. When she was six, she wanted to know the difference between simple interest and compound interest. At ten, she wondered about who owns the money printed by the U.S. government. Now, she’s trading the stock market. She’s the most materialistic and her inclination towards money is:

- Spend but get someone else to pay for it.

- Save, save, save with a focus on collecting money owned to her.

My son is quite different from both his sisters. His wants and needs are simple and usually revolve around screens — a request to rent a movie, an app once in a while, and every blue moon usually coinciding with his birthday, he will request a video game that is not out for another six months. His attitude towards money is:

- No, thank you. I don’t need it or want it.

- I don’t want to spend your money Mommy (with the exception of candy from the drug store).

It’s not surprising to guess who has the most money in their savings account … PickyKidPix.

And who has the least? Grasshopper and Sensei.

As a parent, I clearly have my work cut out for me. One place to start is talking about money with each kid differently. Grasshopper and Sensei needs reinforcement on saving versus spending. Our new saving policy is that I will DOUBLE their saving deposits but they have to keep the money in their account until college.

PickyKidPix takes full advantage of the savings incentive. I am working with her on how the stock market works and what bonds are. She has natural entrepreneurial instincts so we talk about her different business ideas and how to get them off the ground.

My son needs to learn the value of money. Once, when PickyKidPix told him that he couldn’t enter her room without paying her, he handed over $5 for entry. He is generous with his money which I like, but he needs to be more savvy about causes that are worthy of donation.

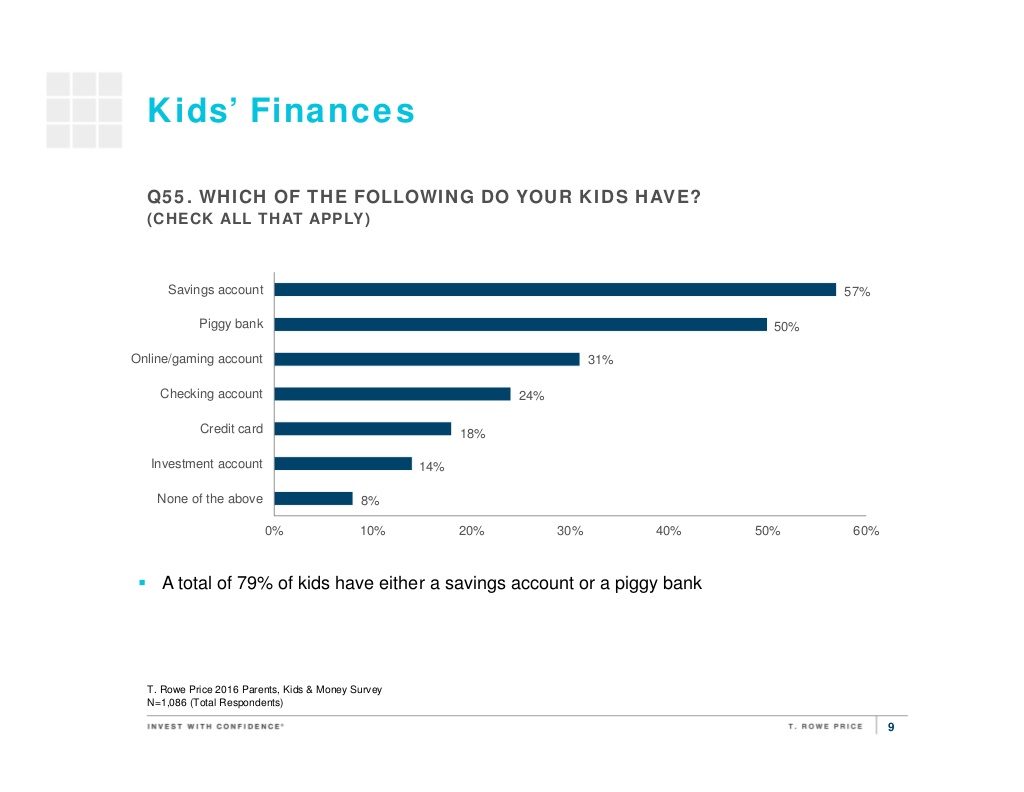

T. Rowe Price’s 2016 Parents, Kids & Money Survey revealed that parents’ behaviors are often at odds with their concerns about setting a good financial example for their kids.

- 71% of parents have at least some reluctance to discuss financial matters with their kids.

- Nearly as many parents are uncomfortable discussing family finances (58%) as they are discussing death (59%).

- And 35% of kids say they are aware with parents are uncomfortable discussing money

I think it’s important to talk about money with kids. Equally, it’s OK to say that you don’t have the answer and that you will look it up together. One summer learning opportunity for everyone might be to create a budget. It could be as simple as $20 set aside for summer activities to either SAVE, DONATE, or SPEND. It’s fun to see what kids come up with.

Summer Learning Ideas to Teach Kids About Money

Summer vacation is a great opportunity to reinforce financial lessons with your children and model smart spending habits. For many kids, summer is a chance to learn how to earn and spend their own money. By earning cash though summer jobs, chores, and allowances, kids can begin to learn lifelong lessons about spending and saving. Here are some ideas for personal finance summer learning for kids:

- Have your child open a bank account. Although interest rates are currently very low, they can still learn about compound interest.

- Make a game out of finding ways to save money. Let your kids come up with ideas for the household to save money. A few examples would be to run the dishwasher only when it’s full, or to wear PJs twice to save money on washing and drying. Let them turn their imaginations loose!

- Take advantage of the articles on the AICPA’s 360 Degrees of Financial Literacy website about talking to children about money.

- For older children with earned income, establish an IRA with part of their earnings (perhaps adding a parental match) to teach them about investing and saving for retirement.

How about you? What has your experience been talking about personal finance with your kids? Please share! Thanks!

p.s. If you are thinking about setting up an allowance system for your kids, here’s some interesting findings from T. Rowe Price’s 2016 Parents, Kids & Money Survey:

- 46% of parents start to give an allowance to their kids between the ages of 5 to 9

- 30% of parents start to give an allowance to their kids between the ages of 10 to 14

- 60% of parents give an allowance that their kids have to earn

- 61% of parents give $10 or less a week as allowance

I’m collecting ideas to teach kids personal finance here on my Pinterest board, Personal Finance for Kids:

BEST #OWNVOICES CHILDREN’S BOOKS: My Favorite Diversity Books for Kids Ages 1-12 is a book that I created to highlight books written by authors who share the same marginalized identity as the characters in their books.

Your son must be an old soul! He’s wise beyond his years. I love how you encourage and work with your kids in their endeavors. Your daughter’s passion and talent for art is exciting. This is such an important post for parents to read.

Thanks so much Patricia! I really appreciate your kind words. We are excited to watch our oldest draw for 6 weeks at the RISD precollege program. We hope our son will agree to do a manga drawing class one day. He likes to draw but he hasn’t wanted a class yet.

I am absolutely charging family members $5 to come into my room from now on. This is brilliant. But seriously, thanks for the great post. Money is slightly terrifying to me and I’m constantly looking for good ways to educate my kids about it!

Hi Jeanette,

I could make a fortune if I charge $5 for every time my kids say, “Mom!!!” We stopped the admission fee pricing but who knows what my middle daughter will cook up next? She’s the one who is the most fascinated by money.

All of these summer learning fun ways for kids are very interesting. I think kids will enjoy learning using such fun ways. Thanks for letting know about these activities.

Thanks so much Erica!