PickyKidPix is now 13-years-old and has shown interest in the stock market for quite some time. Recently, she asked me if she owned any Disney stock. I had purchased a handful of shares when she was born with the money her grandmother (my mother) had gifted to her. My mother had also set up a custodial stock trading account for each of my kids as well. It was her way of helping them with college tuition.

PickyKidPix tells me that she’s been tracking Disney stock (DIS) and that it’s at an all time high. “Can I sell some?” she asks. I spent last summer transferring the kids’ stock accounts into my brokerage account to put all the accounts under one roof, so to speak. I figured that now is a good time to let my daughter trade. I closed her savings account and moved the money to her brokerage account, and figured out the user name and password so she would be good to go.

But then she told me that she intends to make $10,000 by essentially day trading. She would sell the stock every time it went up by $5. Oh no! She forgot about brokerage fees and taxes. Also, day trading is too much like gambling. No, she is not allowed to sell short or trade short-term. All her buys have to be long-term holds based on research on the company’s fundamentals.

In order to do that, I better teach her how to research a company. Let’s start with Disney.

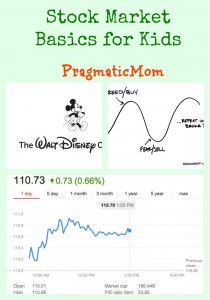

Disney Ticker Symbol: DIS

A stock symbol or ticker symbol is an abbreviation used to uniquely identify publicly traded shares of a particular stock on a particular stock market. A stock symbol may consist of letters, numbers or a combination of both.

Open, High, Low: $110.01 opening price, $110.96 highest price of the day, $110.01 lowest price of the day.

This refers to the stock price on a particular period of time. This chart on Disney shows the price for one day, June 11th.

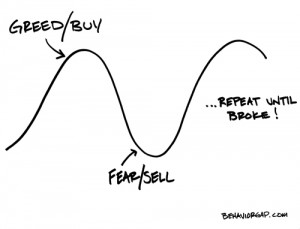

PickyKidPix wanted to know how to sell at the high price of the day and buy at the low price of the day. I told her that basically the only way to guarantee the strike price is to set a BUY or SELL order with a specific price. When Disney hits that price as it wobbles up and down all day as stocks tend to do, your order will execute. Sometimes you will get the stock shares at even a better price that you specified, depending on rapidly the stock prices moves around that day (and if your brokerage house rewards you).

Market Cap: 186.44 B

Market Cap means Market Capitalization or how much the company is worth. For a public traded company, it is simply the number of shares multiplied by the share price. For a private company, figuring out the share price is a bit trickier.

P/E Ratio: A valuation ratio of a company’s current share price compared to its per-share earnings.

Calculated as:

Market Value per Share / Earnings per Share (EPS)

(Market Value per Share DIVIDED BY Earnings per Share)

Disney’s P/E Ratio is 23.82 or the price per share is 23.82 times the money it earns per share.

The idea is here to is to see if the price of the stock seems high to low relative to how much the company is making. A company that is growing very quickly might sell for a high multiple of how much it makes.

Growth Rate: How fast is the company expected to grow?

Disney will forecast (i.e. make educated guesses) on how it expects to do in the near future. It shares this information with analysts who decide if they agree. This information eventually gets shared with everyone via the media.

I like to compare the P/E ratio with the growth rate to see if the stock is overpriced or a bargain.

Notice that Disney is expected to grow 16.77% this year in 2015 but the P/E ratio is 21.71. This tells me that the price feels a little high. I want the growth rate to exceed the P/E ratio in an ideal scenario of buying LOW!

Next year, Disney projects 11.73% growth (I’m assuming in earnings) but the P/E ratio is 19.40. Why? Disney says it’s going to grow slower than this year which means the price for the stock should drop. It could be that the company is projecting conservatively and their surprise high earnings will reward current shareholders. Or, there will be less growth and share price will go down.

Image from BehaviorGap.com

How do we figure this out? We follow them like a detective. We read all we can about Disney, online or off. What movies are coming out? Do we think the movies will be as big as Frozen? Is the Frozen mania wearing off? Ask little kids if they are sick of Frozen stuff. Is all their growth coming from Frozen? Let’s read articles on them. Let’s ask kids about them. Check out retail stores like Target to see if the Frozen toys are discounted due to low demand. Ask your friends and their siblings. Kids are, after all, the target customer!

Let’s read Disney’s annual report. You don’t have to read it all and it’s OK if you don’t understand it all. It the financial report card on the company along with a letter from the CEO. But let’s start by reading it and taking notes on what catches your attention.

PickyKidPix is currently getting stock market information from Yahoo Finance and there are also articles on Disney linked on Yahoo Finance as well. It’s an easy place to get the information you need.

We’ll keep you updated as she explores trading stocks this summer! Are your kids trading stocks at school or for fun? What sites or apps are you using? What resources are you finding helpful? Please share! Thanks!!

p.s. Want to learn more? Here’s a free PDF on Stock Market Basics for Kids that I found.

Related posts I wrote for PickyKidPix:

Teaching Kids About Money: Summer Curriculum

Money Lessons: 5 Key Ways to Teach Your Kids About Money

To examine any book more closely at Amazon, please click on image of book.

As an Amazon Associate, I earn from qualifying purchases.

Follow PragmaticMom’s board Multicultural Books for Kids on Pinterest.

Follow PragmaticMom’s board Children’s Book Activities on Pinterest.

My books:

Amazon / Signed or Inscribed by Me

Amazon / Signed or Inscribed by Me

Amazon / Signed or Inscribed by Me

Food for the Future: Sustainable Farms Around the World

- Junior Library Guild Gold selection

- Selected as one of 100 Outstanding Picture Books of 2023 by dPICTUS and featured at the Bologna Children’s Book Fair

- Starred review from School Library Journal

- Chicago Library’s Best of the Best

- 2023 INDIES Book of the Year Awards Finalist

- Green Earth Book Award longlist

- Imagination Soup’s 35 Best Nonfiction Books of 2023 for Kids

Amazon / Barefoot Books / Signed or Inscribed by Me

You know your stuff. I didn’t understand all of that. Good think I’m invested through my govt 401K. And, I don’t have a lot of options. But, I think it’s great that you are teaching your kids such valuable information. I wish I had those lessons even 30 years ago.

Hi Patricia,

Glad you liked the post! I had to get a degree in business to learn this though!

Mia, this is awesome that your child is so interested in stocks! It’s so important for kids to be financially literate and confident with personal finance. I dabbled in individual stock trading (always holding onto them) but I find I now much prefer index funds. Much easier for me! 🙂

Hi Nina,

Index funds have a lot of volatility and I would suggest mutual funds for you to look into as a middle step between Index Funds and individual stocks. There are tons of them to choose from so that makes it tricky but perhaps meeting with a financial planner would be helpful for you? There are some that charge by the hour too.

Thank you! I’ve always been interested in stocks. This helps a lot! 🙂

Hi Erik,

Glad you found it helpful! I think it’s a great skill to have when you are young. Learn now and make small mistakes and when you are older, you will probably find that you are pretty good at picking stocks.

My 13yo nephew who is visiting us does stock trading! He was telling me about it, and he follows a lot of your tips. I think I need him to teach me about stocks, but your post is a great place to start!

Hi MaryAnne,

Wow, he sounds very financially savvy!! Have him teach a class for you and your kids who are interested. It’s nice to learn from someone who is right there to answer questions.

Wow this is very educational! I have no idea about stuff like this, I normally keep my money in shares until I need them. I’m impressed by your daughters interest! #BabyBrainMonday

Hi Emma’s Mamma,

Sounds like you know what you are doing with your stocks! I’m hoping my daughter will learn when she’s young and make her mistakes on a smaller scale now.

If my son comes to me and asks about stocks in about 10 years, I’ll know where to send him – thanks for this really, really useful post! #babybrainmonday

Hi Jemma,

Glad it might interest him at a later date! 🙂

This is brilliant! Definitely an idea for arjun as he gets older. It’s so important to have finance literacy – something I wasn’t taught at school!

Hi Harps,

Glad you can use it later with your son!