PickyKidPix wants to trade stocks this summer using her stock account that her grandmother set up for her AND her own money. Too bad I forgot the password. It might be faster for me to transfer her account to my brokerage account than to actually figure it out!

I tried to sign us both up for a Community Education class on the basics of the stock market. Alas, they called back because 1) I forgot to put the security code of my credit card on the form, and 2) they said you have to be 16-years-old to take an adult class. There are no stock trading classes for kids though.

When I called the nice people at Charles Schwab, they said that they hold stock trading classes at their local branch in my town. Hurray, I thought! I’d save the money on the class plus the time! But … when I went to sign up, the classes were much farther away and way too advanced for my 11-year-old.

Back to square 1.

I decided to teach her the basics of stock trading myself: I call this Teaching Kids about Stocks and Investing 101.

I learned the old-fashioned way in m early twenties. I used a pamphlet from Charles Schwab plus a method commonly known as trial and error. I also followed a few helpful blogs: The Motley Fool at AOL and Morningstar reports. Both are free.

My business partner started trading stocks in high school. He did so well that he had adult family friends give him tens of thousands of dollars to invest for them. In college, my friend continued to invest his money but didn’t always come up with winners. Turns out that Cabbage Patch Kids were a fad, unfortunately. But mistakes made early can be small and inexpensive and a great way to learn the ropes.

To start off PickyKidPix, I want something that she can wrap her head around. I’m also not a person who likes to do extensive numerical analysis or create spreadsheets to pick companies. “Keep it Simple” works for Warren Buffet, I figured, so I make it simple for myself.

Teaching Kids How to Trade Stocks

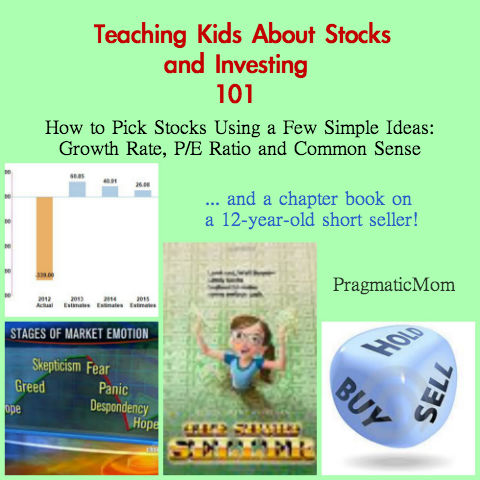

I stick to a few rules for trading long which is to say, buy and hold:

1) Do you understand the business? Can you explain what the company does in one or two sentences?

2) Why do you think this company is going to do well? Is it the people running the company? Do they have some kind of (protected) service or product? Have a theory and test it out. Do a little research to see if this is true.

3) What is the expected projected earnings growth rate? You can find this on their prospectus. Earnings is a fancy word for profit. Profit is what you earn after you pay for everything to run your business.

I’m using Facebook in 2012 as an example:

Facebook, Inc. has a 1-Year Projected Earnings Per Share Growth Rate of 32.65%, Earnings Per Share Growth Rate of 79.57%, and Net Margin of 26.95%. from Seeking Alpha

4) What is the P/E ratio? This is the acronym for Price to Earnings Ratio. You can also find this on the company prospectus or on the site you are using to track their price. It simply is a ratio that is trying to gauge if the price is high (or low) relative to how much the company makes in terms of good old fashioned profit.

You will notice high-tech start-ups will have very high P/E ratios which means they are priced for future earnings because they sure aren’t making much money now!

Here’s the P/E ratio for Facebook.

5) Then, I compare the project earnings growth rate to the P/E ratio.

Projected Growth Rate: 32.65% (From 2012 data so this is their best guess for 2013)

P/E Ratio: 60.85% (2013 estimation)

If the projected growth rate is faster (or higher) than the guess for the P/E ratio, I think that this is a good buy.

It’s not perfect science since these numbers are all a guess but it seems to indicate that the company is not hugely overpriced.

So … if Facebook met all my other expectations: I can explain what it does; I can explain why I think it’s poised to take off; I really like this company and would love to own a small part of it, then the only decision left is when to buy. Is this a good time to buy or should I wait? Will the price come down or go up? What is my best guess?

A final caveat: more learned stock analysts would say that the projected earnings are built into the price and therefore into the P/E ratio but this works for me. Buy Low, Sell High is only useful in hindsight.

A Book for Kids Who Want to Trade Stocks

The Short Seller by Elissa Weissman

PickyKidPix and I really enjoyed Elissa’s previous chapter book, Nerd Camp. Her latest book is about trading stocks. Ms. YingLing Reads has a review on it here:

This certainly has a lot of good information about the stock market, and lots of math. If math teachers are looking for a novel to use in the classroom, this might be it. This author won the 2011 Cybils Middle-Grade Fiction Award for Nerd Camp.

12-year-old Lindy is stuck at home with mono and ends up trading her father’s online trading account as a way to alleviate her boredom. Turns out she’s pretty good at trading stocks so why not bet the farm using her parents’ savings? Nothing possibly could go wrong! Or could it?

PickyKidPix will be reading this book this summer and I’ll let her tell you what she thinks about it, particularly as a story for a young stock trader. I’ll do my own review as well as soon as I finish it. We discuss selling short versus buying long and we both agree that selling short is too risky.

And here’s the trailer!

Financial Literacy for Kids Link Round-Up

Here’s a few interesting links I’ve come across on financial literacy for kids. It seems that there is a worldwide movement (no doubt motivated by the last recession) on teaching kids about personal finance in school. I’ll all for it!

Financial-education curriculum: income, purchasing, credit, saving, investing, and insuring.

The stock game gives students a taste of real-world investments.

High School Students do Taxes for Free

Can you please share any advice, links, or books that you use or find interesting to teach kids about personal finance? Or leave a question of what you’d like me to post on that you want your child to learn. Let’s get our kids financially savvy together, shall we?

images from TobaccoPRC.org, and The Equilcom Stock Market Tips.com

p.s. Related posts:

Who Owns the Money? Economics for 4th Graders

Teaching Kids About Money: Summer Curriculum

Top 10: Ways to Teach Kids about Money

Indigo, Samurai and My Daughters’ Clothing Company

Teen Entrepreneur: indigo clothing co. co-founder presents at Entrepreneurship Day

My Daughter’s Team Wins BlueGreen Innovation Challenge!

8 Tips for Teaching Your Kids Financial Responsibility

To examine any book more closely at Amazon, please click on image of book.

As an Amazon Associate, I earn from qualifying purchases.

BEST #OWNVOICES CHILDREN’S BOOKS: My Favorite Diversity Books for Kids Ages 1-12 is a book that I created to highlight books written by authors who share the same marginalized identity as the characters in their books.

I don’t know nearly enough about stocks! That book sounds interesting, and I would definitely approve of teaching kids personal finance in school!

Hi MaryAnne,

Stock trading is not for all kids but I do think that by high school, it’s great experience to have a stock portfolio and experience buying and selling, if only a mock one. I didn’t have that experience growing up and I wish I had.

When my kids were little I got into the Rich Dad Poor Dad series and ended up buying their ridiculously expensive board game I think it was called Cash flow (for adults) and then there was one specifically for kids. It was very interesting and taught Rich Dads method of making money but, not worth the price I paid. I could probably still use your course.

Hi Faigie,

I like that Rich Dad Poor Dad book! My mom sent me that one. I think I also read The Millionaire Next Door and a few others. They are all great books for adults! The board game for kids sounds interesting!

I could sell you mine if you’d like (lol)

Thanks Faigie!

I need to teach myself a lot of this before I teach kids! You have provided a plethora of information about investing. Thanks for sharing!

Hi Barbara,

I think that learning together is also legit and kids are surprising good at thinking about what the company does and why they are doing a good job. The stats might seem intimidating but it’s just a few numbers you look up and compare and is the basis for a discussion of whether or not this is a good time to buy. I’ll post more about buying and setting parameters for the price next.

I agree it’s important to get kids thinking about how to manage their finances. So far, we’ve only gotten them their savings accounts, but it would be fun to start expanding on that.

Hi Asianmommy,

One of my kids is really into this so I just follow her lead. But it’s fun to see what kids gravitate towards in terms of money. As a parent, you can see how they will handle their personal finances as they get older. So far, only one of my three kids is savvy with money! But they are learning.