4th Grade Economics: The Money System

My college roommate, Rosie Rios, signs the money as the Treasurer of the United States. Raised in Hayward, California by a single mom with her 5 siblings in a two-bedroom apartment, she is the epitome of the American success story and I am so proud of her. I saw her at my 25th college reunion and she kindly signed three “Rosie Bills” for my children. (Yes, technically they are defaced, but I’m taking them out of circulation forever as a collectible so I guess it’s not really defacing. It’s memorabilia.)

PickyKidPix loves money — she’s 10 years old — and wants to be a billionaire when she grows up. It’s driving her crazy that my friend Rosie can’t keep some of the money that she makes. I tried to explain the manufacturing of money in terms of a soccer ball factory and PickyKidPix gets that her manufacturing manager can’t take soccer balls. (In this scenario, she owns the soccer ball company and spends her time counting the money. Her friend Kate is in charge of the manufacturing floor and is going to a family reunion with 60 kids who play soccer). “Obviously,” PickyKidPix says. “She can’t take the soccer balls. That would be stealing. FROM ME!!!!”

For days and even weeks, she is bothered by WHO OWNS THE MONEY? We did some research and now she’s bothered by WHO OWNS THE U.S. MINT? And mostly, her question is WHY CAN’T ROSIE JUST TAKE A FEW STACKS OF TWENTY DOLLAR BILLS. IT’S NOT LIKE SHE CAN’T JUST PRINT MORE!!!

And that is just it. It doesn’t seem fair to her that Rosie can’t take some of the money she makes. To PickyKidPix, money is something that can easily be replaced by just printing more. Her question is subtle in its complexity and so I’m attempting to explain this so that a 4th grader can understand. Most of this information is from Wikipedia.

p.s. Now my daughter is curious about digital currency such as Bitcoin and Paybis. Cryptocurrency and Blockchain technology is the next frontier in learning about money.

p.p.s. My husband sent me a great link on 6 Fascinating Facts About Cash from Fortune Magazine.

p.p.p.s. Here’s a photo of Rosie introducing the new $100 bill to a classroom! Treasurer Rosie Rios shows off a new 100-dollar bill to students in a virtual classroom visit with Rogers-Herr Middle School in Durham, NC. One of the students was a final grand prize winner in the Save Out Loud contest hosted by Ready.Save.Grow campaign.

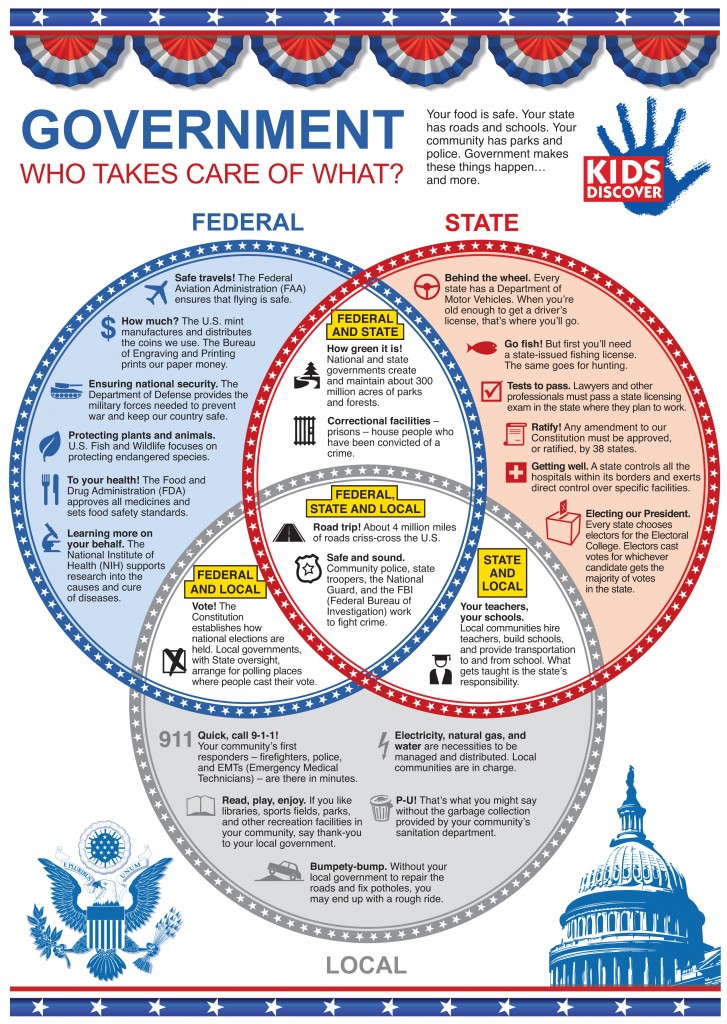

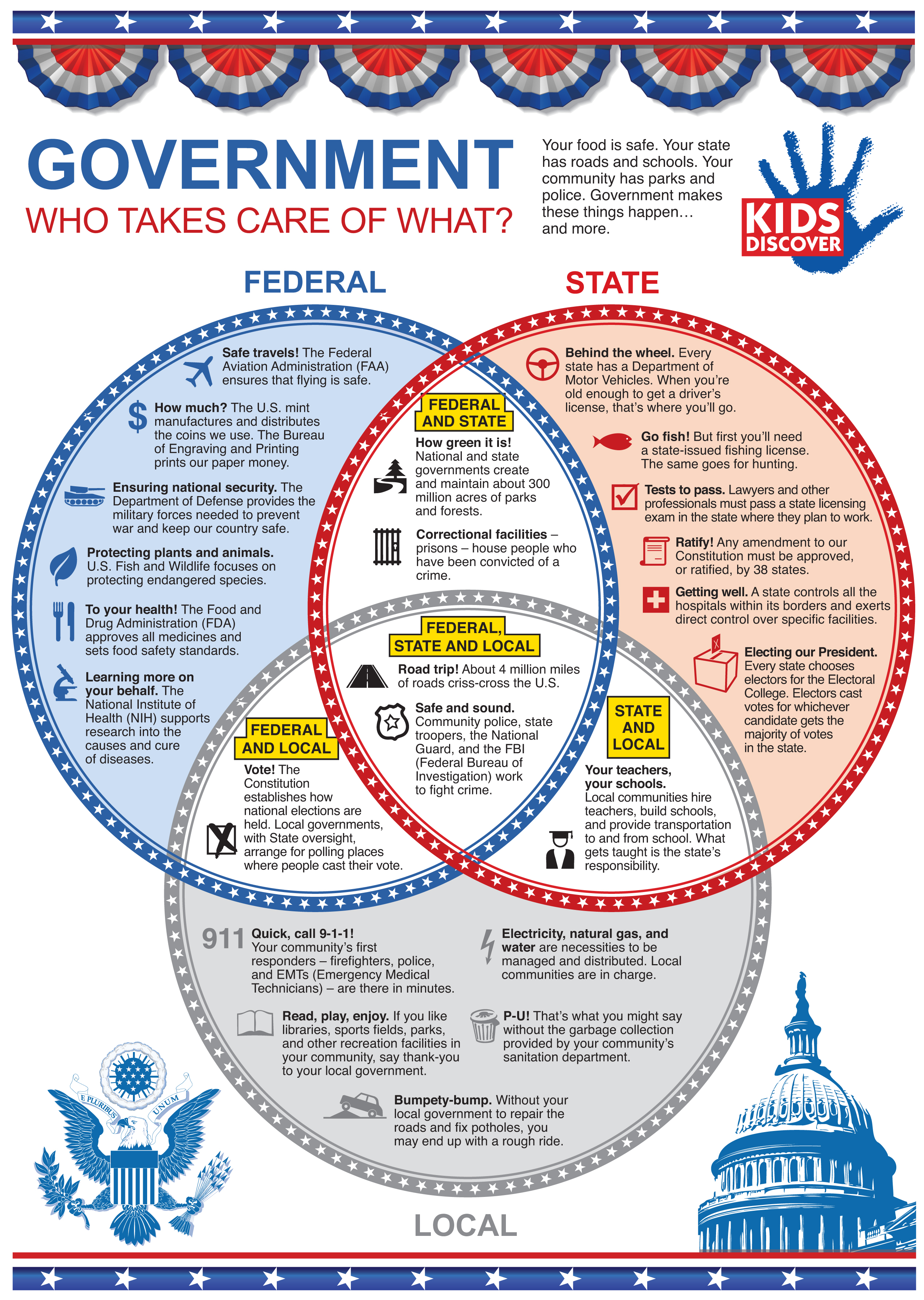

This handy chart from Kids Discover shows $ How Much?

The U.S. Mint is part of the Federal Government and manufactures and distributes the coins we use. The Bureau of Engraving and Printing prints our paper money. Rosie is in charge of both of these government departments.

This is from Kids Discover

This is from Kids Discover

Who owns the U.S. Mint and Bureau of Engraving and Printing?

The U.S. Mint and Bureau of Engraving and Printing are part of our Federal Government. These departments manufacture and distribute the coins and bills we use.

The Treasury prints and mints all paper currency and coins in circulation through the Bureau of Engraving and Printing and the United States Mint. The Department also collects all federal taxes through the Internal Revenue Service, and manages U.S. government debt instruments, with the major exception of the Federal Reserve System.

What is the U.S. Treasurer In Charge of?

The Treasurer of the United States has direct oversight over the U.S. Mint, the Bureau of Engraving and Printing and Fort Knox and is a key liaison with the Federal Reserve. In addition, the Treasurer serves as a senior advisor to the Secretary in the areas of community development and public engagement. (This is Rosie’s job.)

Who Owns The U.S. Federal Government?

The outline of the government of the United States is laid out in the Constitution. The government was formed in 1789, making the United States one of the world’s first, if not the first, modern national constitutional republic.

The United States government is based on the principle of federalism, in which power is shared between the federal government and state governments. The details of American federalism, including what powers the federal government should have and how those powers can be exercised, have been debated ever since the adoption of the Constitution. Some make the case for expansive federal powers while others argue for a more limited role for the central government in relation to individuals, the states, or other recognized entities.

One of the theoretical pillars of the United States Constitution is the idea of “checks and balances” among the powers and responsibilities of the three branches of American government: the executive, the legislative, and the judiciary. For example, while the legislative (Congress) has the power to create law, the executive (President) can veto any legislation — an act which, in turn, can be overridden by Congress. The President nominates judges to the nation’s highest judiciary authority (Supreme Court), but those nominees must be approved by Congress. The Supreme Court, in its turn, has the power to invalidate as “unconstitutional” any law passed by Congress.

Why Not Just Print More Money?

This is the key question of why the United States (and therefore Rosie) can’t just print endless amounts of money. This questions shifts from a question of Government in terms of who OWNS the money to one of economics. The question now for PickyKidPix is WHAT HAPPENS IF THE U.S. PRINTS ENDLESS AMOUNTS OF MONEY (thereby now allowing my friend Rosie and anyone else who works to make the money to take a pile of bills for herself).

The simple explanation is that prices rise when the government prints more money. For someone studying economics, here’s the reason along with graphs. This illustration is from The Slow Bleed.

Imagine the government printed more money and sent every man, woman, and child $5,000. Sounds good right? Some people would save it, but the bulk would run out and buy a flat-screen television, go out for dinners, or even pool some money and buy a new Harley-Davidson (my personal choice).

The issue is everyone now has more money – equally. So now the value of the dollar has decreased (there are more of them out there). Think of trading cards or collectibles – they are worth more when there are fewer of them available.

Prices are determined by supply and demand (yes, there are some other factors but let’s not bother with those right now) which is also a way of saying “ability” to pay in some cases.

Back to the store; Let’s say only 100 people could (normally) afford the flat-screen television at your local Best Buy. But now more people have money and more people go to the store to buy one.

The first week the television sells out. Well, we can’t have that in a store (and the demand has gone up) so now the prices will as well. Basically what you have now is inflation.

Inflation would not be limited to the television. It would occur on everything. Bread, Milk, Gas, Electronics, etc, etc.

So, in a nutshell, printing more money simply raises the prices of everything but the net effect is still the same. If you can’t afford it now, you won’t be able to afford it then!

I think PickyKidPix will need a crash course in economics to grasp this concept. The Supply and Demand book will be illuminating for her. I may go so far as to do that classic graph of supply versus demand. She was convinced that if we just printed as much money as we wanted (and everyone who prints money took home $1 million dollars a day each for themselves and their friends) that eventually a loaf of bread would cost $1 million but most people would not make enough money to afford the bread except for the really rich people and the people who work printing the money.

I found more great books on money and economics for kids of every age. What do your kids think about money? Do they know who owns it? Can they describe it? It’s really an abstract concept for anyone but especially for kids.

Books Children Should Read to Learn About Money

One Cent, Two Cents, Old Cent, New Cent by Bonnie Worth

THE CAT IN the Hat puts to rest any notion that money grows on trees in this super simple look at numismatics, the study of money and its history. Beginning with the ancient practice of bartering, the Cat explains various forms of money used in different cultures, from shells, feathers, leather, and jade to metal ingots to coins (including the smallest—the BB-like Indian fanam—and the largest—the 8-foot-wide, ship-sinking limestone ones from the Islands of Yap!), to the current king of currency, paper. Also included is a look at banking, from the use of temples as the first banks to the concept of gaining or paying interest, and a step-by-step guide to minting coins. A fascinating introduction is bound to change young reader’s appreciation for change!

DK Eyewitness Books: Money

Here is an original and exciting look at the diverse world of money. Stunning real-life photography of Egyptian silver, Chinese hole money, Spanish gold, and siege money – as well as today’s international currencies – offers a unique “eyewitness” view of money. See the salt money of Ethiopia, what the earliest coins looked like, forged coins and banknotes and what one million dollars looks like. Learn how coins and banknotes are made, why German children used bundles of money as building blocks and why Ancient Greeks put coins in the mouths of dead people. Discover the history of your country’s money, where the first paper money was issued and how to detect forged coins. And much, much more!

Money Madness by David A. Adler

What’s all this madness about money? Long ago, people traded rocks or sheep for the items they wanted, but rocks were heavy and sheep ran away. This beginning guide to economics will have readers thinking about the purpose, and not just the value, of money.

What is Supply and Demand? by Paul Challen and Gare Thompson

With current times defined in large part by the recent economic downturn, the books in the Economics in Action series are a timely choice to introduce students to some key and often interlocking concepts. What Is Supply and Demand? delves more deeply into the cornerstone economic principle touched on in many of the other books and is probably the best choice to read either first or as a stand-alone title. In each book, stock photos and sidebars do more to break up the layout than provide much additional insight, but the design as a whole is inviting enough to make these economic principles far less dreary than many kids might think. A good series for establishing a solid economic bedrock. Grades 5-8. –Ian Chipman from Booklist

To view any book more closely at Amazon, please click on image of book.

As an Amazon Associate, I earn from qualifying purchases.

BEST #OWNVOICES CHILDREN’S BOOKS: My Favorite Diversity Books for Kids Ages 1-12 is a book that I created to highlight books written by authors who share the same marginalized identity as the characters in their books.

LOVE this! heck, I just learned a few things myself. I really want to print this chart and place on the teens’ bedroom wall.

Hi Vanita,

I learned a lot myself writing the post. I didn’t realize there were two centers; one for coins and one for bills but I guess that makes sense. Rosie sure must be busy with all of this!

very cool, thanks for this post!

Hi Nat,

Thanks so much! Glad you liked the post!

Very very interesting. My son and I are overdue to discuss money. We’ll be somewhere and he’ll ask if I have money. If I say no, he’ll say, But you have your debit card. I need to sit him down to discuss how our budget works. I found two sites that *might help (haven’t figured out for sure yet). Tykoon.com and threejars.com.

As always, thanks for an interesting post!

Hi Dee,

I know what you mean. My kids used to ask for money and when I said I didn’t have any, they would say, “Then go get Daddy’s wallet.” Thanks for the site suggestions. I will check them out. I think money and personal finance is such a great topic to cover with kids. Hopefully it keeps them from getting into credit card debt trouble when they hit college or beyond.

Very cool! I think I am with PickKidPx! One little stack… No one will notice! Glad you posted this because kids want to know these things and sadly there are so many things, like this, I have no idea about!

Hi Ann,

It does seem unfair, doesn’t it? No free samples for Rosie or anyone. They are a little strict about that! 🙂

Oh and your roommate, so inspiring!!!

Hi Ann,

Thanks so much! I’ll be sure to relay your kind comment to Rosie.

Money can be a touchy subject especially in marriages. When a couple does not agree on how their income should be spent, arguments ensue.

Hi Katherine,

I totally agree with you! I think everyone should learn about money and personal finance and that children can learn these lessons as well which hopefully prevents money issues like credit card debt later in life.

Thanks so much for the helpful summary. You are so right that money is a very abstract concept for kids (and adults!), especially when considered in the context of macroeconmics, inflation, etc. The Adler book is a great one. We also love NPR’s Planet Money podcast–some of the topics they discuss seem peculiar but my son and I listen to it in the car and it really spurs some interesting discussions.

There is a propaganda aspect to this answer about “Why can’t the government can’t just print more money?”

The government has, in fact, done this massively since the financial crisis. The mechanism is that they “loan” it at zero or near zero interest rates to major banks. What do the banks do with the money? To a large extent, they turn around and loan the money back to the federal government in order to finance the federal deficit. Make no mistake, the major banks have a huge stake in promoting the propaganda that the government can’t just “print money”. Otherwise, their risk-free role standing in the middle wouldn’t be necessary.

I’m not saying that the government can always just “print money”, but as the article you quoted says, the value of money is a function of both supply AND demand. Right now, demand for money (other than to finance government debt) is very, very low.

Hi Class of 1987,

Thanks for making such great points! My 10 year old is so fascinated with money and I find it challenging to give her explanations that are accurate but at her level. Plus, I was never an econ major!

I don’t mean to be pedantic. Thanks for indulging me. Basically, I think we are being conned by a nation.

Hi Class of 1987,

It does seem like a charade that if we think times are good and we keep spending then every thing is fine. It’s like the economy is just in our state of mind.

Hi Class of 1987,

You bring up good points!

Mia,

Great post! I’m always glad to see economic analysis in the blogosphere…it’s a topic many people simply do not understand.

On that note, I’ve published a follow-up to this post on HansEconomics.com. Don’t worry…it’s all positive! Your comments just raised a few issues that I thought would make good content for my blog. Admittedly, my post is probably beyond the level of analysis you were shooting for here, but I thought you might be interested in reading it (link below). Again…thanks for the post!

http://hanseconomics.com/2013/01/10/the-dark-side-of-monetary-inflation/

Thanks HansEconomics!

Your explanation on monetary inflation is great! I will send PickyKidPix over there to read it. She is very fascinated with the concept of money and even though she’s only 10-years-old, I like to give her as detailed an explanation and she desires. Your article might be a little over her head but it will be good for her to get another perspective on inflation and the role of government. Thank you for including me in your post!